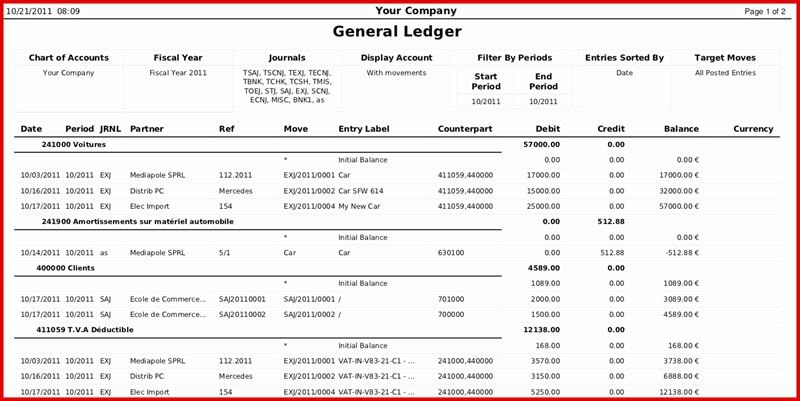

A journal entry a description debit and credit columns and a balance. O The general ledger describes all liability accounts.

Features Of General Ledger Accounting

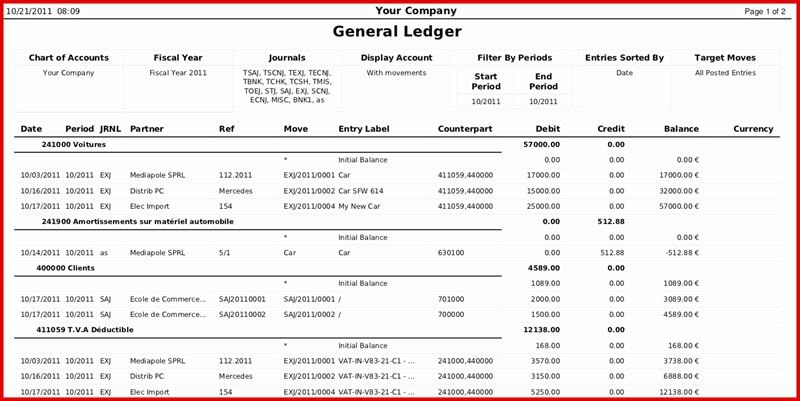

The general ledger is the primary accounting record of a company that uses double-entry bookkeeping.

. A general ledger provides information to produce other financial reports. The ledger contains the accounts of the business categorized by account classification. A general ledger is an accounting record that compiles every financial transaction of a firm to provide accurate entries for financial statements.

The purpose of the general ledger book is to provide a permanent record of all financial transactions and balances classified by account. If youd like to contact Toast please call us at. A general ledger is a recordkeeping system used to sort store and summarize a companys financial transactions.

General ledgers transactions are entered as either a debit or a credit. O The general ledger combines sales and expenses to determine the net income of a business. Try it free for 7 days.

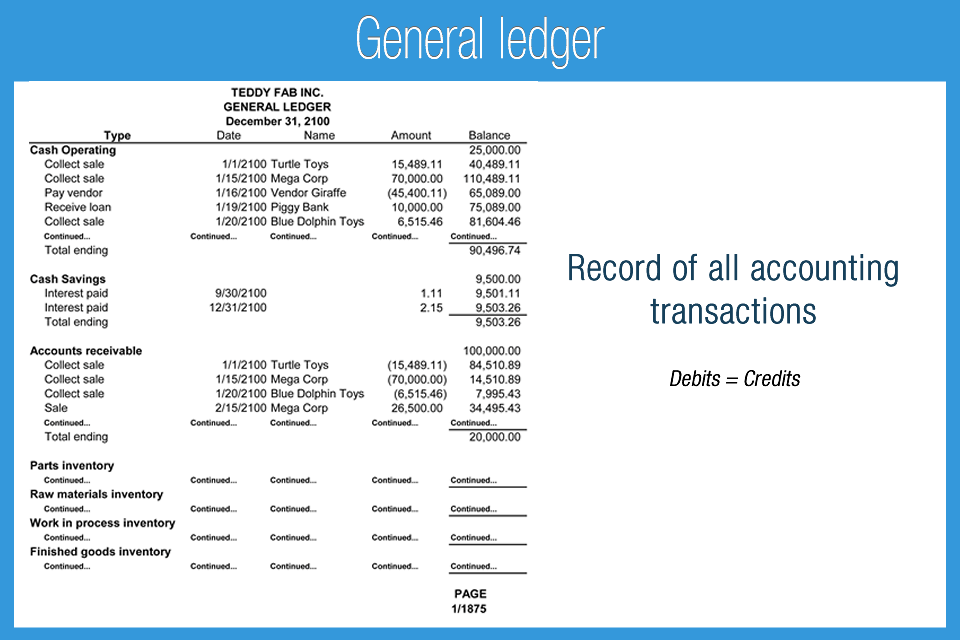

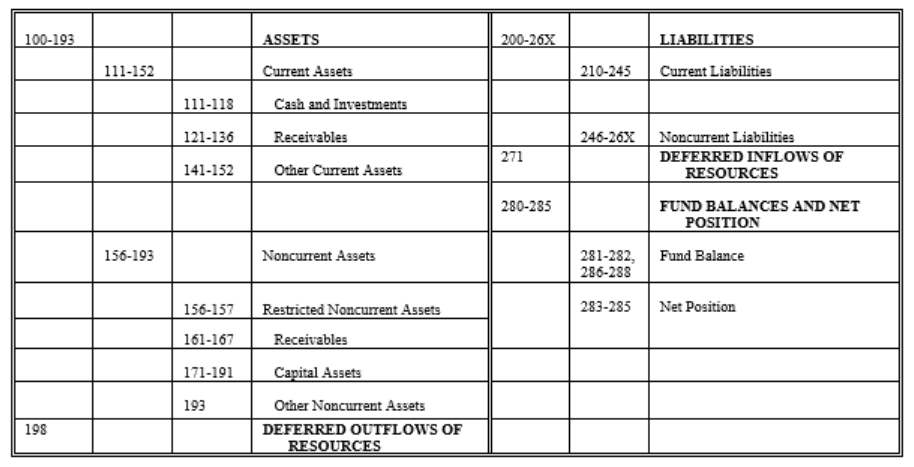

The account balance information contained in the ledger. A book with separate pages for each account. General ledgers list transactions under seven categories.

No books needed - keep track of your income and expenses all in one place with accounting software like Debitoor. Email Email is required. Restaurant Name Restaurant Name is required.

Accounts include assets fixed and current liabilities revenues expenses gains and losses. Each account is a unique record summarising each type of asset liability equity revenue and expense. The ledger will determine the accuracy of information recorded in the journal.

A trial balance is compiled from. One of the basic financial statements of an organization A record on which are recorded the increases and decreases of a particular financial statement component such as cash A list of account titles and balances at a certain date A grouping of the accounts used by an organization to prepare its basic financial. It arranges or sorts the business accounts as the balance sheet order.

It is known to help one to have a record of each financial transaction that occurs during the operations of an operating firm. The basic sequence in the accounting process can best be described as. A general ledger is a grouping of all of the accounts that a law firm uses to categorize and track the firms business transactions.

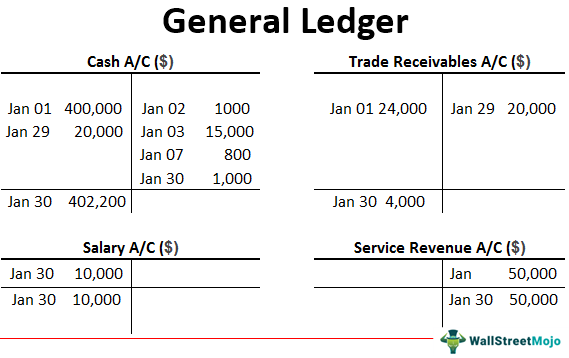

What is a general ledger. It has a debit and credit account records. It lists every accounting transaction for you to review.

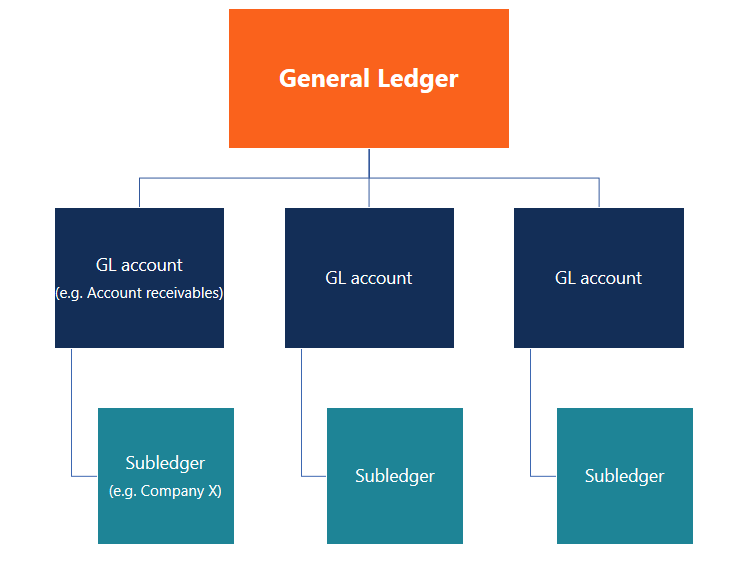

Think of the general ledger as the main database of a companys financial records and information with other financial documents being derived from the information recorded in the general ledger. A general ledger is known to be a document that is said to be the record-keeping system used by a companys financial data. First and Last Name First and Last Name is required.

The general ledger GL is the main ledger and contains all the accounts a business uses in its double entry bookkeeping system. What is the general ledger. Assets liabilities owners capital revenues.

A general ledger GL is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. The general ledger is a master accounting document providing a complete record of all the financial transactions of your business accounts receivable and accounts payable. Phone Number Phone Number is required.

Gain loss assets liabilities equities revenue and expenses. A general ledger has four primary components. The information in the general ledger allows.

It is a central repository for accounting data transferred from all sub-ledgers. The transactions in the journal and the accounts in the ledger are linked together by a transfer process called. General ledger accounts encompass all the transaction data needed to produce the income statement balance sheet.

It is the source of financial information required to prepares financial statements. The general ledger is the foundation of a companys double-entry accounting system. The general ledger tracks five prominent accounting items.

The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total. 2A service used by dealerships to ensure that the customer has enough funds in their bank for the payment to clear prior to accepting payment by check or debit. In the past the general ledger was literally a ledgera large book where financial data was recorded by hand.

The general ledger is a vast historical data archive of your companys financial activities including revenue expenses adjustments account balances and often much more. The ledger can be thought of as. The general ledger is a summary of a company bookkeeping system.

1 2 The information found in the general ledger accounts is used to generate the firms balance sheet and profit and loss statement. 1A service offered by the DealerTrack DMS that sends a file to the bank to transfer funds to the employees bank account rather than cutting the employee a check. The ledger contains a list of business transactions arranged by date.

The general ledger also called a general journal or GL summarizes all the financial information you have about your business. O The general ledger is a record of all transactions in alphabetical order O The general ledger is a record containing all accounts used by a company This problem has been solved. The ledger is known as the book of original entry.

The general ledger details all financial transactions of all accounts so as to accurately account for and forecast the companys financial health. It helps you look at the bigger picture. The general ledger can be described as.

Accounts that are usually included in the general ledger are. A general ledger is the foundation of a double-entry accounting system. A general ledger is a book or file that bookkeepers use to record all relevant accounts.

More than one of the above. General ledgers transactions are entered as either a debit or a credit. A general ledger stores and summarizes all accounts a business operates.

General Ledger Ensures Debit Equals To Credit

General Ledger Accounts Office Of The Washington State Auditor

General Ledger In Accounting Meaning Examples

General Ledger Gl Overview What It Records Effects Of Blockchain

0 Comments